4/15/2021

A Year at YouTube

I joined YouTube as a Product Manager in April of 2020. I onboarded at the beginning stages of the pandemic, at the time when we all expected it to end in a matter of weeks. When I joined, I got to understand the impact of the pandemic on YouTube as a content and ads business, specifically across the TV, media, and entertainment worlds. I noticed how the traditional business model that I was ramping up on had begun to get upended by slowed advertising dollars met with rising viewership and video consumption, specifically for categories in live streaming.

YouTube is a video-sharing platform with several strategic priorities. First, the community of YouTubers is integral to the success of the platform. Engagement from users with creator content is at an all-time high, with the “creator economy” boosting the perception of online video creators and the success they’ve garnered through platform monetization. Second to that, YouTube has developed an advanced OTT service, giving users the ability to watch content from traditional TV providers like HBO, NBC, and ABC, through both the YouTube main platform and YouTube TV. What powers this dual strategy is YouTube’s enhanced monetization capabilities built on top of the immensely scaled Google ads stack and sales force.

Up until a few weeks ago, I was working with a small team managing all things TV, from the content distributed on YouTube main on TV devices as well as YouTube TV. The team is primarily focused on growth, in driving new subscribers and ad spend for YouTube TV as well as developing the OTT technology for the YouTube main platform. My daily schedule often rotated between discussions on active or in the pipeline content deals, sales and packaging strategy, and product and engineering technical and strategic priorities and implementation. My primary responsibility had been to manage stakeholders across the business: product managers, engineers, designers, partner managers, sales, marketing, legal. My work was two-fold: 1) help YouTube build a scalable platform for partners across live sports, entertainment, gaming, and tentpole events and 2) help those partners grow their audience and overall revenue with the platform’s monetization capabilities.

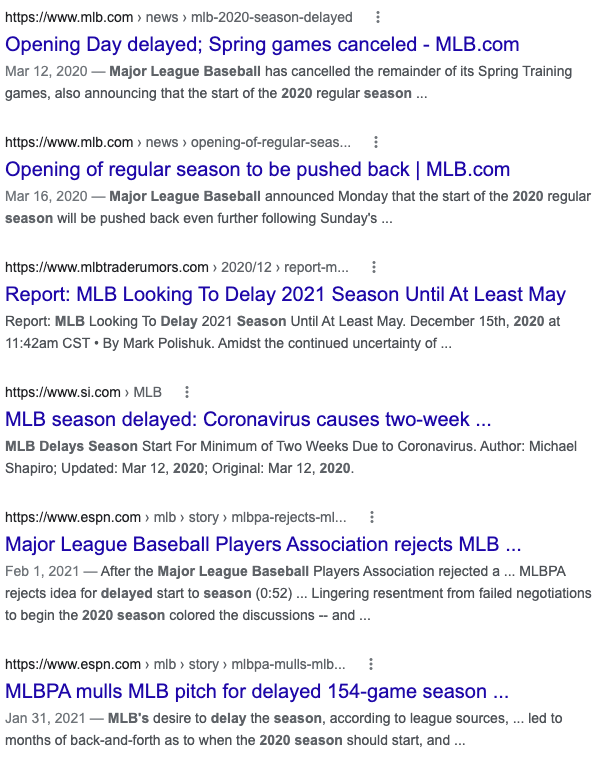

One of the first things I started to work on was executing on a monetization plan for YouTube’s exclusive live sports deal with Major League Baseball (baseball being something I know close to 0 about). The ramp up was quick as our team had to be ready by the end of the month. This meant executing live testing on spring training games as a start, aligning teams on development goals, soliciting advertiser sponsorship commitments, and planting seeds for our post-launch strategy for expanding to non-sports partners.

Just like all of us, live sports was also on lockdown. Our team across sales, product, engineering, marketing, and operations were patiently waiting for the greenlight from the MLB to start the season.

On the monetization side, our product had yet to be fully tested. Our launch was entirely dependent on our ability to serve ads in real-time and our launch plan had gotten derailed by the possibility there would be no live sports season. As a product manager, you’re the one expected to get your team to launch and unblock team- and product-wide challenges. For me, the challenge was in maintaining momentum with my team to ensure we were always ready to launch at any given time MLB may tell us we’re on (could have been in a day or in a month). The second implication was ensuring that our product would be in good shape down the line. We were scoping a 2-3 year product plan and if we missed a test opportunity, we’d be set back to pursue future live content deals.

Four months later, after lengthy negotiations with our content partnership teams and countless adjustments to launch plans, MLB gave us word that they would be giving us 4 mixed exclusive games to stream on YouTube throughout the month of September.

A $15 billion dollar advertising machine

In 2020, for the first time Google reported YouTube’s annual revenue - amounting to the platform bringing in $15 billion a year (~10% of Google’s total annual revenue). YouTube’s core business is in advertising - selling the best content made and distributed on the platform to advertisers so viewers can watch the content on any device for free.

YouTube’s focus on advertising is entirely based on its founding mission: “give everyone a voice and show them the world.” Distributing content on the internet should be without a cost to the viewer and YouTube has made its business viable through selling content.

Content on YouTube is spread across 4 categories: AVOD (ad-supported video on demand e.g. any video with ads), TVOD (transaction video on demand e.g. pay for a movie), PVOD (premium video on demand e.g. pay for YouTube Premium to watch ad-free videos), and Live (e.g. creator live streams or live events like Coachella).

YouTube has been able to balance the needs of those content categories by selling YouTube as the primary destination for video.

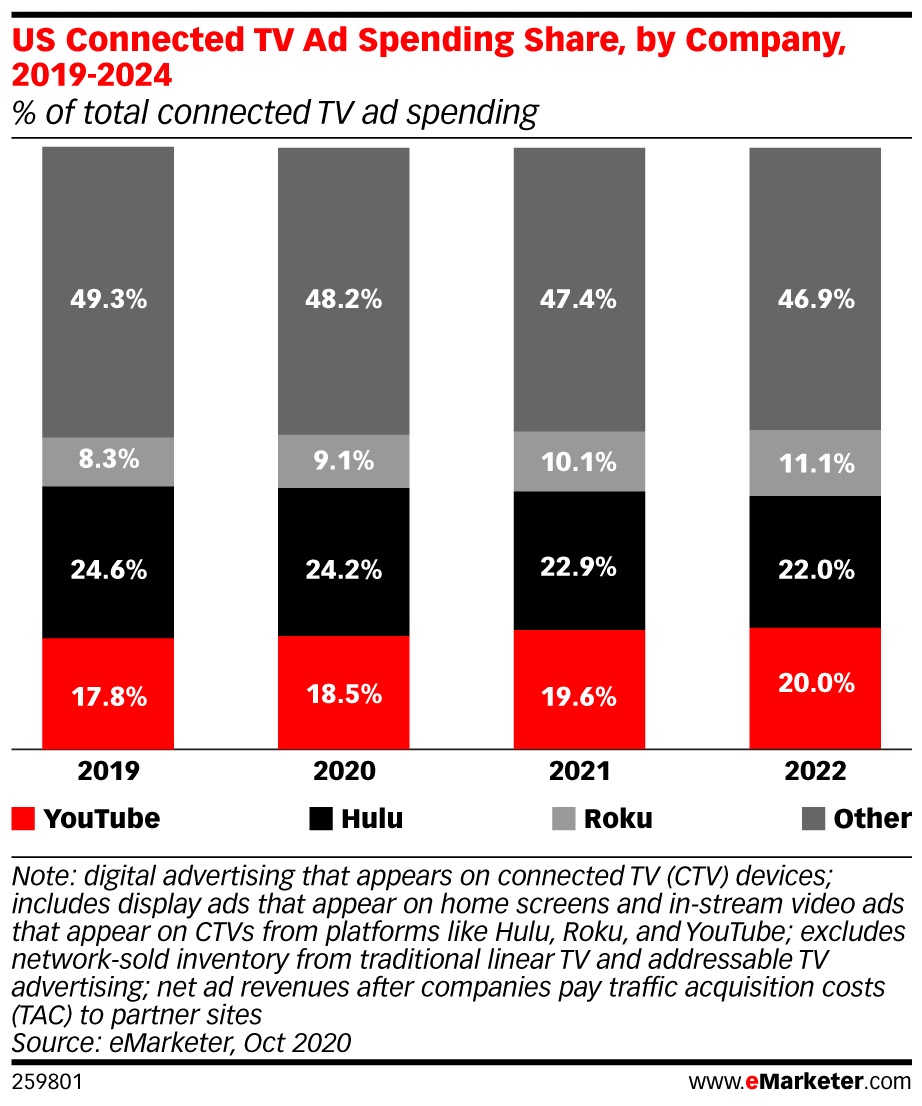

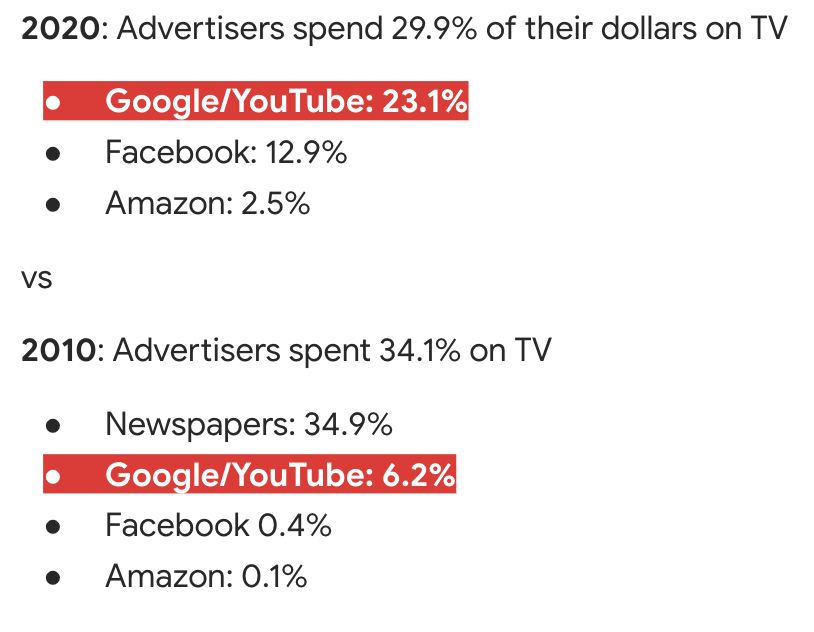

YouTube’s growth has largely been its ability to disrupt the traditional TV advertising market. Some additional context here: advertisers consider players like YouTube, Facebook, and Amazon as part of their “digital” spending vs their “TV” spending. Over the years, advertising from TV has shifted to digital as a result of the above platforms’ popularity, engagement, and better measurement and targeting capabilities. COVID-19 has accelerated this shift even further.

Source: eMarketer

Source: WSJ

The way YouTube is able to capture media ad spend is through traditional media buying.

Media buying has largely stayed the same way since the Mad Men era: advertiser buying through what’s called an Upfront, the primary avenue for Reservation-based advertisers (advertisers looking for guaranteed impressions) to make buying commitments for an entire TV season and secure low, negotiated pricing for high-value inventory.

Upfront buyers are typically large ad agencies like GroupM, an agency responsible for purchasing ~$63 billion in ads each year (clients include Google, Unilever, Ford, and more). YouTube will sell ads through the Upfront to sell the majority of its inventory to Reservation buyers. It will also target Scatter buyers, or Reservation advertisers booking commitments on a monthly or quarterly basis. Lastly, YouTube also sells their inventory to Auction buyers, the least-expensive of the bunch, where buyers aren’t looking for guaranteed commitments but rather the ad system is optimizing ad placements based on who’s the highest bidder.

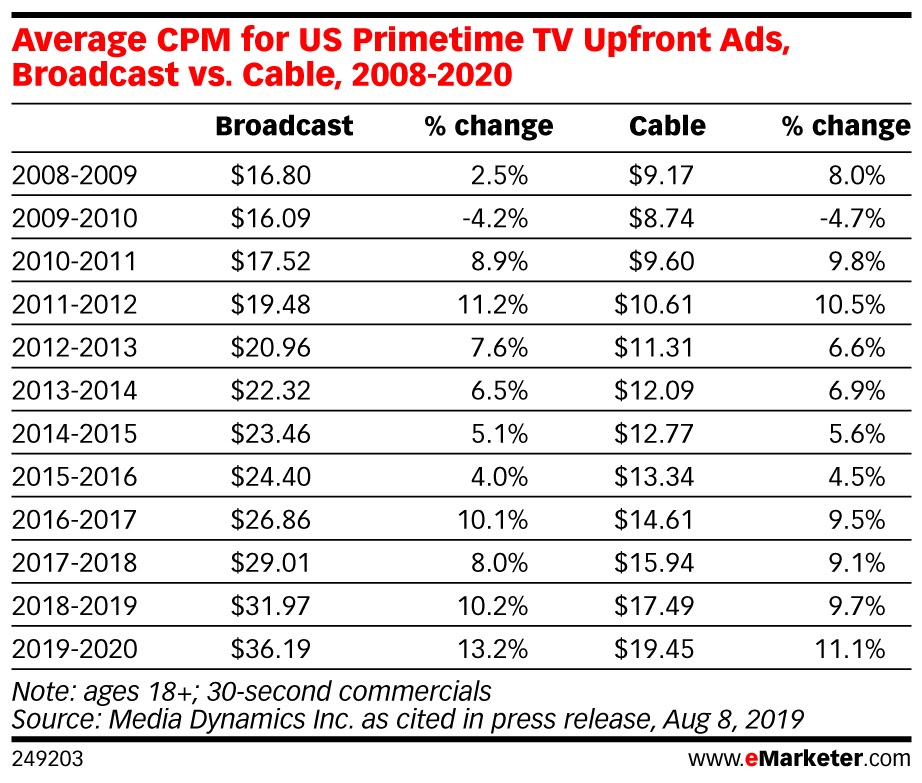

Upfront is where broadcast, cable, and TV get the highest bank for their buck. Even though linear, cable, and broadcast is declining, CPMs (cost per 1000 ad impressions) are still increasing.

Source: eMarketer

Content is king, but you need more than just really good content

YouTube is known as a content platform and the primary way it makes money is through selling the value of the platform as an aggregator of the internet’s best content. For advertisers, they’re looking to evaluate the value of the content available (in sales terms; how valuable and/or scarce is the ad inventory)?

My team has been responsible for the way in which we monetize high value live content streams (like MLB live sports). For this type of content, brand advertisers book sponsorships to promote their products/services on high viewership streams. Given the high acquisition cost for live sports deals like the MLB and the NFL, our teams need to be able to recoup content costs with advertising dollars. Therefore, one way we aim to make the economics work is through selling live content directly to advertisers.

Similar to how advertisers group budgets, content providers divide distribution rights into digital and TV. Offering up exclusive content to a digital platform means TV providers lose out on the content to air on their local and national cable networks. Therefore, hand-shake deals made by the likes of Fox typically lead to exclusive deals being made across 2-5 year time frames where exclusive high-viewership games are entirely reserved for traditional TV providers vs emerging digital players.

On the flip side, leagues like the MLB, NFL, and NBA view YouTube as a digital technology partner. Being able to partner with YouTube means both a young audience reach (cord-cutters) as well as access to interactive product features. YouTube's value is both in attracting incremental audiences (people moving away from traditional TV) and unique platform capabilities (live chat, search and discovery, digital scoreboards and player stats).

On the other hand, advertising is not only the business of selling content directly. Content is one piece of the puzzle. When considering booking $x-xxM on a platform, advertisers consider content as a secondary factor - other primary factors being reach (e.g. unique audience viewership), safety (e.g. brand suitability), perception (e.g. brand association), and any other market-level solutions large advertisers may request (formats, measurement, targeting, brand lift).

One of the largest successes for YouTube Ads is a bundled content offering called YouTube Select (formerly known as Google Preferred). It packages the best content on YouTube with respect to viewership, likes/comments/subscribes, and overall engagement across numerous content categories (gaming, comedy, music, sports, etc). Advertisers optimizing for brand awareness book YouTube Select campaigns to achieve global audience reach (2 billion viewers) and run across a wide array of content with human-reviewed brand suitability.

For scarce inventory (content that isn’t available throughout the entire year), sellers would sell based on individual packages. For YouTube Select, the value is both the quantity and quality of the content available (e.g. thousands of videos users watch over the year). In other offerings, advertisers are interested in scarcity - this is especially pertinent for live content like the MLB which only runs in seasons and may be exclusive to one digital or TV platform.

YouTube is a well-oiled machine, but growth comes with a balancing act

Overall, YouTube is a well-oiled and scalable ads and content business - growing year over year with a mission to distribute the best video content globally, whether that means competing with the likes of Amazon / Hulu or Instagram / Snapchat.

Because YouTube has to manage partnerships with content providers (e.g. HBO, ABC) in addition to creators (e.g. Emma Chamberlain, Mr. Beast), growth efforts often get stalled by conflicting priorities for two disparate parties. The difficulty lies in being able to compete in a social environment as well as against streaming giants. In recent years, YouTube has aimed to grow its monetization capabilities by letting creators partner with brands directly, increase channel transactions with SuperChat or Channel Memberships, and has recently reported paying out $30B to creators over the last 3 years.

I look forward to keeping tabs on YouTube’s continuous new content launches across live sports, entertainment, and creator content.